There’s a bridge between knowing what customers want in advance and accomplishing it – customer behavior analytics. Behavioral insights equip the line of action intended to create personalized customer experience. Customer behavior analytics offers the sought customer wisdom – what customers bought, when, how they bought, how often they buy, what channel they use – and customer behavior analytics helps organizations strengthen customer acquisition, engagement & experience, and customer retention strategies. Customer behavior analytics can help us get insights to know how a customer behaves in a given set of conditions and predict future behaviors.

What’s the takeaway from the customer behavior analytics exercise? We understand the customer better and then what?

Can we use customer behavior analytics to increase sales, retention and revenue?

Customer behavior analytics could serve as the feed to accomplish different business objectives – Targeted marketing, fraud detection, personalized customer experiences, customer retention, increasing CLTV among others. How to connect customer behavior analytics to your business case?

Customer behavior analytics for customer retention

Let’s work around Customer behavior analytics in a scenario revolving around a bath soap brand. This is also about finding how behavioral insights in connection with the soap purchase can set the cue for marketing. Of all the 3 soap flavors, you find customers who have used all the 3 flavors, who are regular buyers of this soap brand. There are customers who have tried only 2 soap flavors but are also known to buy other soap brands. There are also customers who have bought this soap brand (1 flavor), but have since not bought this soap brand.

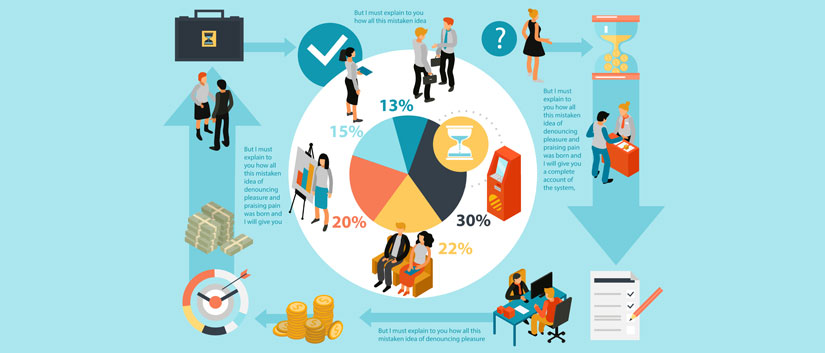

Customer segmentation based on customer behavior analytics becomes relevant in terms of planning the marketing action. Customer behavioral analytics encompassing frequency patterns, buying habits, preferences for promotions can give us 3 customer buckets, say for instance, through the customer segmentation exercise. What follows is the step to connect behavioral insights to targeted marketing – Marketing promotions covering coupons, discounts and offers can now be rolled out based on the customer segments built based on customer behavior analytics.

Customer behavior analytics for fraud detection

Daisy uses her mobile device for doing her online shopping. The location, frequency of shopping remains invariably the same. Now, there’s a transaction with a retailer conducted from a different location, wherein the purchase amount is almost three times higher than Daisy’s average purchase value. Is this a warning bell to stop the fraudulent transaction in its tracks using customer behavior analytics?

Customer behavior analytics for fraud detection is another case of behavioral insights being used to construct behavioral profiles wherein all critical features of customer interactions, as that of purchase amount, device being used for transaction, location and frequency of transactions help create behavioral portraits and which help detect if a transaction is genuine or fraudulent.

Machine learning techniques and customer behavior analytics

Behavioral insights can be a critical fodder for unearthing customer needs. Using behavioral data as one of the critical machine learning feeds for the customer segmentation exercise – data including spending frequency, product usage, preferences, and benefits desired – organizations can promote attractive products to specific customers. Clustering as the machine learning technique comes in handy wherein clusters of customers with the same buying behaviors can be created. Critical customer features can be unearthed to maximize value from the clustering exercise and customer behavior analytics.

A bank wants to use customer behavior analytics to increase sales, retention and revenue; predict customer behavior and improve targeted marketing. Customer demographic data, product used, and transactions make up for critical data wherein classification techniques are brought into play to make the most of customer behavior analytics and target the right customers with the right products as part of targeted marketing efforts.

For a global expert in data capture and categorisation sector that wanted to gain insights into consumers’ credit behavior & earning and spending behavior as part of their insight and decision solutions, we helped the company utilize MI and AI to generate behavioral insights based on critical KPIs, roll out personalized marketing as well as cross-selling based on customer segmentation, and serve customers better. The client was able to use customer behavior analytics to increase sales, retention and revenue in terms of empowering its clients with customer insights to achieve sales and revenue growth.