The year 2024 is expected to witness a great deal of money muling and the rise of preventive measures using Generative AI. Financial institutions are casting their nets to find money mules and thwart their plans to set up new pathways. As financial fraud takes new forms, new-gen AI has bolstered fraud detection empowering organizations to proactively thwart fraud attacks and transform fraud detection.

Sample this one.

At a bank, fraudsters using the cloak of ‘gather-scatter’ pattern would have succeeded in their money laundering scheme had it not been for the Generative Adversarial Network driven solution. The graph and tabular features aided GAN was quick to spot the fraud patterns that would have not been spotted otherwise.

How to use Generative AI to bolster Fraud Detection?

Generative AI as Fraud Co-pilot

Generative AI powered Fraud Co-pilot is revolutionizing fraud detection with its enhanced precision levels and faster-time-to-detect fraud. Large Language Models (LLMs) are ground-breaking in terms of learning the intent, context and language, and in cohort with Generative AI serves as a Fraud Co-pilot.

Here’s a Credit Union that used Fraud Co-pilot. In quick time, they found 42% of risky transactions immediately. Where the fast-evolving frauds hoodwink the rules-based systems, Fraud Co-pilot automated the rule creation as well as tuning. This helped the credit Union detect fraud better and do away with the trial-and-error method.

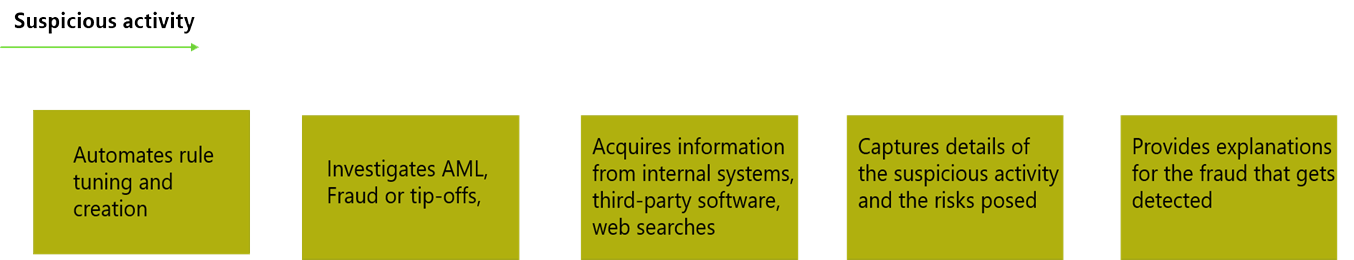

Consider the scenario of real-time payment. These are transactions that are irreversible and instantaneous. With Generative AI powered Fraud Co-pilot, financial institutions are a step ahead in dealing with the new fraud trends, reacting, and detecting faster. What capabilities are packed into the Fraud Co-pilot?

The Fraud Co-pilot is context-aware, comprehending the type of investigation and rolling out responses best suited to thwart the risk associated with the threat.

LLM Powered by Retrieval Augmented Generation (RAG)

What is retrieval-augmented generation?

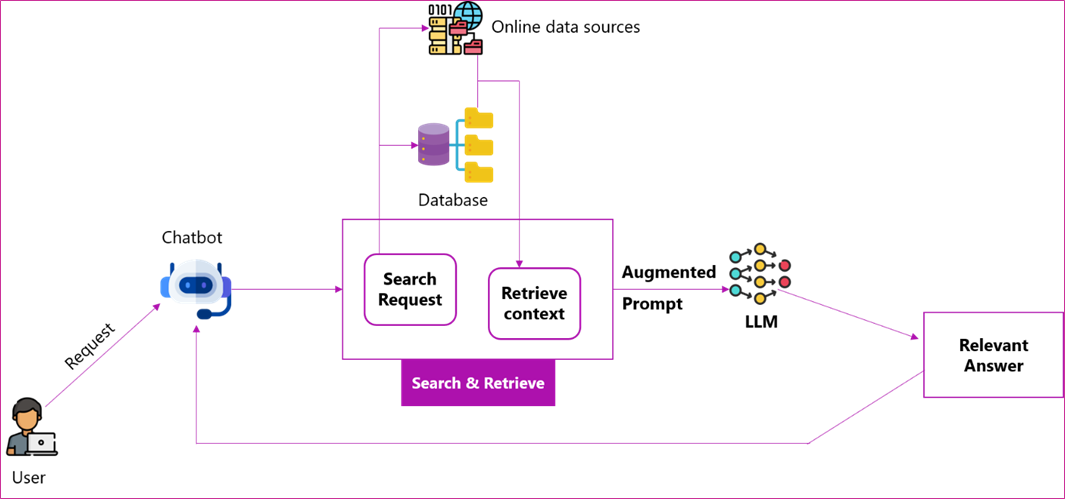

To get optimized output from LLMs, RAG helps acquire knowledge fetched from external sources that lies outside of the training data sources prior to producing a response.

Let’s take the case of the LLM based chatbot that assists a user to make speedy decision making. Here’s the flow of the RAG process for better understanding.

If the user is a fraud analyst performing manual fraud review, say to verify details, the LLM based chatbot entwined with RAG can retrieve information details from policy documents to accelerate decision making in terms of determining if a case is fraudulent or not.

Leveraging Graph Neural Networks for Fishing Out Suspicions Activity

Fraudsters come up with new schemes and strategies to go unnoticed. If you employ tabular machine learning like XGBoost, you have only got the edges covered wherein only the ‘person sending vs person receiving’ scenario is considered. The complex context is lost in the plot.

Rule-based systems can fail when pitched in to handle complicated context failing to notice fraudulent patterns. In comes the Graph Neural Network that enable graph databases for storing transactions – Here every node point to accounts and every edge point to transactions.

GNNs come good in situations where complex transactions involving longer chains are used to deliberately confuse and make it complex to understand.

How it works?

Say we want to employ GNNs for fraud prevention in financial transaction. Where financial institutions, merchants, and customers are entities, relationships between these entities can be modelled in a graph using GNNs. Here customer or a financial institution is represented as a node and the relationships between entities become the edges. GNNs can record complex activity patterns and detect suspicious behaviour. Going beyond single transaction, GNNs acquire information available in local neighbourhoods of transactions, thereby identifying larger patterns.

Generating Synthetic data

If there is a challenge in identifying a fraudulent activity using ML models, lack of training data is a major hurdle dealing a severe blow. There is severe imbalance between non-fraudulent records vs fraudulent records in datasets. This in turn makes the training of ML models difficult.

Data imbalance can pull down detection accuracy. With Generative AI, a financial institution was simulating fraud attacks by creating synthetic payment sequences. The combination of genuine data and synthetic samples could feed the fraud detection models with balanced training set.

If Generative AI can be powerful tool to prevent fraud, synthetic data is one way propounded to increase data records for training fraud detection models. For instance, Python-based libraries can be used to generate synthetic data. If there is a need to increase data points, SymPy can be used. For creating relational data, Synthetic Data Vault (SDV) can be used. Platipy is a Python library that serves well to generate fresh sample data.

Synthetic data can enhance the sophistication of variety of examples in training the ML models to pinpoint even the most recent fraud technique used by the fraudster.

Perking up Anomaly Detection with GNNs

Here’s a rare event used by fraudsters to outsmart fraud detection. They roll out complex transaction chains to steer clear of any attention or notice. This is an event that deceives the traditional rules-based system which can fail to spot patterns. As GNNs propagate passing of information from nodes and edges to neighbouring nodes, a node gets information from other nodes that are quite distant from a specific node.

In being receptive and sharing information, GNNs are capable of tracking complex & long-winding transaction chains and detect anomalies that might otherwise have gone unnoticed.

Generative AI is a major shift towards bolstering fraud detection to bring transformational changes in terms of increasing accuracy, reducing false positives, increasing operational efficiency & cost savings, and enhancing customer trust.